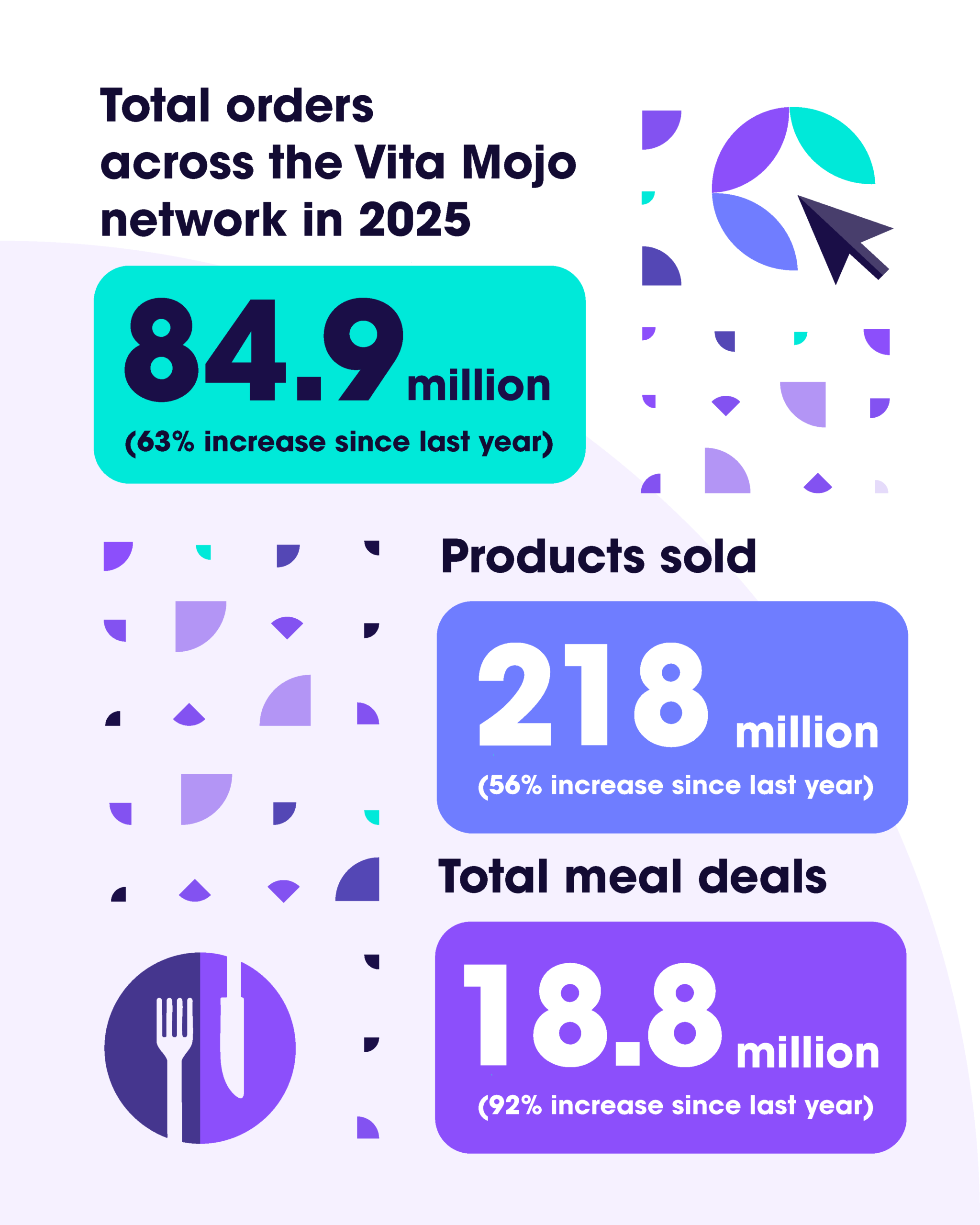

Across 3,100+ locations in 2025, quick-service restaurant (QSR) brands processed 84.9 million orders through the Vita Mojo network. That’s a 63% jump from last year. It tells us something important: digital ordering isn’t just growing, it’s becoming the default way people eat out.

Behind those numbers sit real customer behaviours, menu trends, and operational patterns that shape how QSRs operate. We’ve pulled together the most interesting insights from 12 months of data to see what actually happened this year.

218 million products sold

Every order tells a story about what’s working. In 2025, Vita Mojo’s network sold 218 million individual products, up 56% on last year. But the real standout was meal deals, which jumped 92% to reach 18.8 million transactions.

Meal deals work because they simplify choice and increase perceived value. When customers see a bundled offer, they’re more likely to add that extra side or drink they might have skipped otherwise. The 92% increase suggests more operators are getting their deal structure right.

When a giveaway goes too well

Dave’s Hot Chicken discovered what happens when a promotion exceeds all expectations.

On 23rd October, the brand gave away 3,897 free sliders. The response was so overwhelming that Dave’s had to temporarily close its London, Birmingham and Liverpool sites.

It’s the kind of problem most brands would love to have. Limited-time offers create urgency, and free items drive foot traffic.

Thursday 30th October: the busiest day of the year

Peak trading days reveal patterns about customer behaviour. Thursday 30th October saw 321,860 orders across the network, making it the single busiest day of 2025.

Drilling down further, the busiest hour was 12pm–1pm on that same day, with 53,721 orders processed in 60 minutes. That’s nearly 900 orders per minute across the network. Having systems that can handle this kind of volume without crashing or slowing down is essential during peak periods.

42% of customers are returning

New customers matter, but so do the ones who come back. In 2025, 58% of QSR visitors made their first order with a brand. That means 42% were repeat customers, placing their second, third, fourth order and beyond.

Loyalty programmes play a role here. Since Honest Burgers launched its Honest Insiders scheme in June, the brand has given away 40,498 portions of onion rings. That’s the most popular loyalty reward in the network. It’s working because it’s simple, desirable, and easy to redeem.

Building repeat business costs less than constantly acquiring new customers. When nearly half your orders come from people who’ve bought from you before, those relationships are worth investing in.

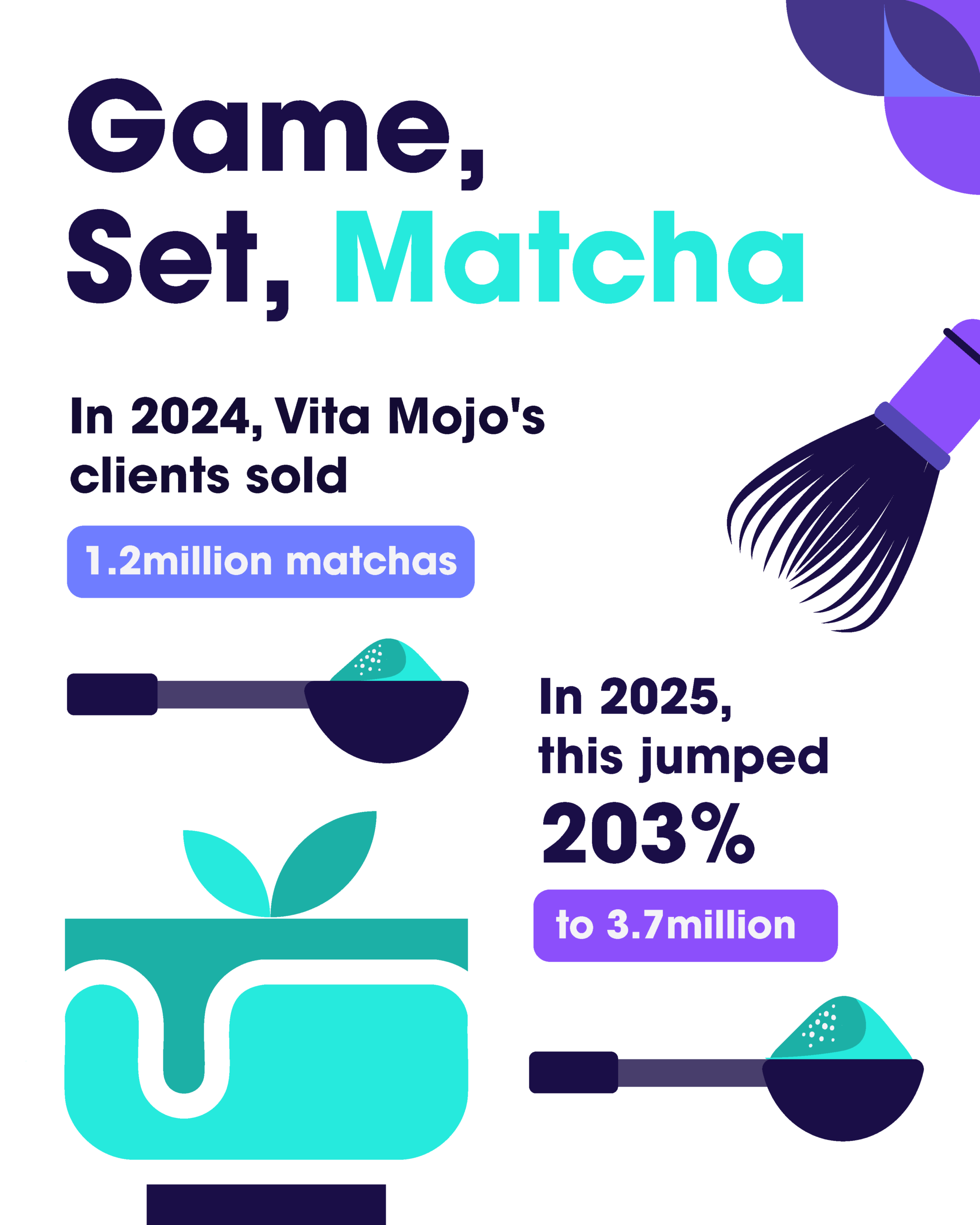

The matcha moment

Last year, Vita Mojo’s clients sold 1.2 million matchas. In 2025, that figure hit 3.7 million, a 203% increase. Matcha has moved from niche to mainstream, and QSRs have noticed.

Coffee shops and cafés are expanding their menus to include matcha lattes, iced matchas, and matcha-based drinks. The growth reflects broader customer interest in alternative caffeine sources and potential health benefits. If you’re not offering matcha yet, your competitors probably are.

How people order matters

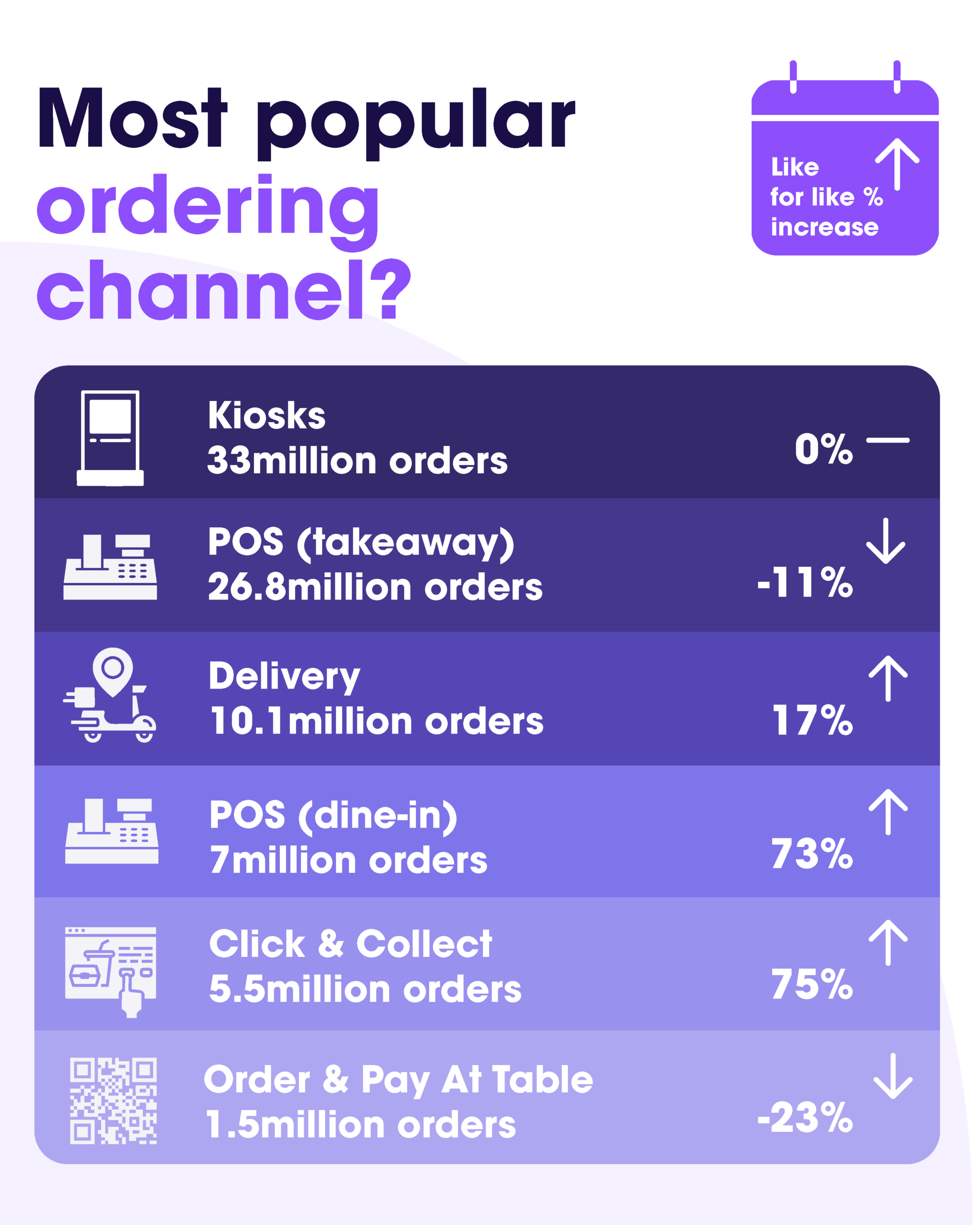

Ordering channels tell you where customers prefer to engage. Kiosks led the way in 2025 with 33 million orders. They’ve retained their popularity because they reduce queues, give customers time to browse, and remove the pressure of ordering at a busy counter.

Click & Collect saw the biggest like-for-like percentage jump at 75%, reaching 5.5 million orders. Delivery surged 17% to 10.1 million orders. Both channels offer convenience, and customers are willing to pay for it.

Traditional POS orders (takeaway) still accounted for 26.8 million orders, but slipped -11% like-for-like. However, dine-in POS orders increased, up 73% to 7 million.

Operators who offer multiple channels capture more occasions. Someone might order at a kiosk on Monday, use Click & Collect on Wednesday, and get delivery on Saturday. Each channel meets a different need.